Bitcoin Price Prediction: BlackRock Holds Over 662,000 BTC as Institutional Growth Sparks Decentralization Debate

BlackRock’s Bitcoin Strategy

Since its debut on January 11, 2024, IBIT has shattered ETF growth records, reaching $72.4 billion in assets under management in just 341 trading days—far surpassing the pace set by gold ETFs in their heyday. This extraordinary momentum not only highlights the rapid adoption of Bitcoin by institutional investors, but also marks a clear evolution in financial market attitudes toward digital assets. The focus has shifted from the question of whether to invest to determining the optimal allocation.

BlackRock positions Bitcoin as a long-term asset allocation vehicle, seeking equilibrium between volatility and scarcity. The firm recommends that investors allocate 1% to 2% of a traditional 60/40 stock-bond portfolio to Bitcoin, aiming to enhance portfolio diversification and bolster resilience against inflation.

Challenges to Bitcoin’s Decentralization Ethos

Bitcoin was conceived as a counter to the centralization prevalent in traditional finance. Yet, with the world’s largest asset manager now holding over 660,000 BTC, the inherent tension between decentralization and institutional concentration has come to the forefront. While Coinbase Custody provides secure storage, insurance and compliance for these holdings, most investors are still exposed to Bitcoin through centralized channels.

This dynamic lowers the entry barrier for participants but also draws criticism for potentially undermining Bitcoin’s core principle of decentralization. The market appears to be gravitating toward a hybrid model. Decentralization serves as the foundational layer, while large-scale capital is primarily funneled through ETFs and institutional platforms.

Market Impact and Future Outlook

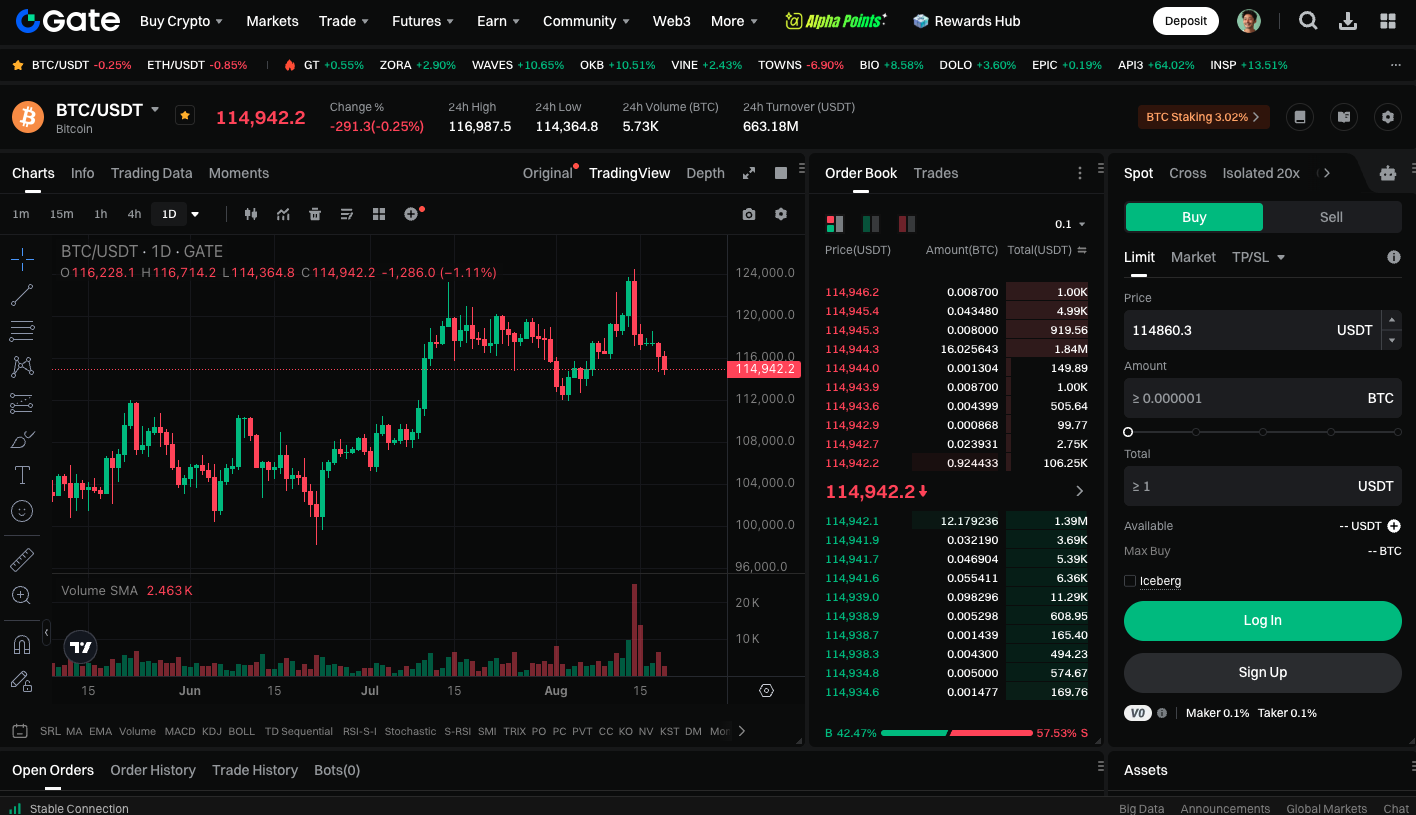

Market forces are currently putting short-term pressure on Bitcoin prices. If the $115,000 support level holds, a rebound may follow. If selling pressure intensifies, Bitcoin will likely test even lower support thresholds.

At the same time, the explosive growth of ETFs demonstrates an unstoppable wave of institutionalization. ETF issuers such as VanEck have projected that Bitcoin could approach $180,000 in 2025. This projection aligns with BlackRock’s aggressive accumulation strategy. However, some academics warn that excessive financialization could introduce risks from traditional markets, including flash crashes triggered by algorithmic trading or liquidity imbalances in ETFs—potentially shifting Bitcoin’s volatility drivers from retail sentiment to systemic risk factors.

To start BTC spot trading, visit: https://www.gate.com/trade/BTC_USDT

Conclusion

Bitcoin is at a decisive crossroads. On one side, institutional momentum is cementing its legitimacy in mainstream finance; on the other, its fundamental ethos of decentralization faces dilution. For investors, this moment represents both risk and a once-in-a-generation opportunity.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025