ETH Price Prediction: Can Institutional Inflows Trigger the Start of Altcoin Season?

Derivatives Market Surges

According to a report by Singapore’s QCP Capital, open interest in Ethereum perpetual futures has skyrocketed from under $18 billion to more than $28 billion in just the past week. This represents an extraordinary leap. This surge pushed the Altcoin Quarterly Index past the 50-point mark for the first time, a level not seen since December 2023.

Large block trades on the CME and leading crypto exchanges reveal that this influx of capital is driven primarily by institutional investors, not retail traders. This structural shift suggests that institutions are now leading the current bull market cycle.

ETH Positioned as the New Digital Infrastructure

QCP notes that last week’s passage of the GENIUS Act in the United States served as a key catalyst for this rotation of capital. The Act mandates that issuers of USD stablecoins hold 100% of their reserves in short-term U.S. Treasuries or cash and comply with Bank Secrecy Act regulations, establishing a new standard for regulatory compliance in the stablecoin ecosystem. Against this backdrop, smart contract platforms like Ethereum, Solana, and Cardano are seen as the backbone of future stablecoin applications—much like Bitcoin is regarded as digital gold.

Will ETH Hit $4,500 by Year-End?

QCP further points out that bullish expectations for ETH by year-end are mounting, as significant capital flows into out-of-the-money call options, reflecting strong optimism for Ethereum’s prospects in the fourth quarter. ETH’s market cap share has climbed from 9.7% to about 11.6%, while Bitcoin dominance has dipped to 60%. If this momentum continues, more altcoins could experience similar capital inflows.

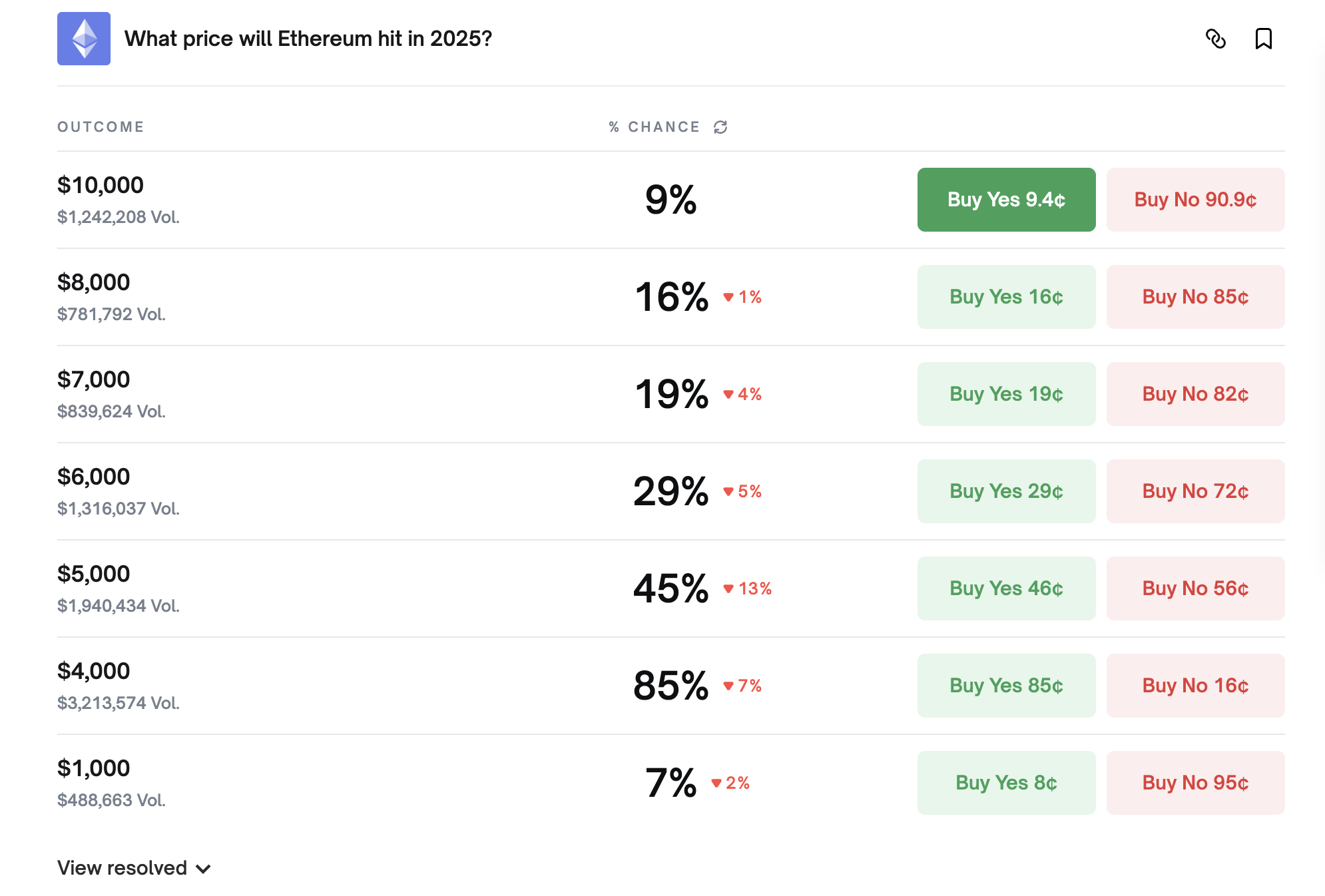

According to prediction market Polymarket, as of press time, there is an 85% probability that ETH will reach $4,000 by 2025.

(Source: Polymarket)

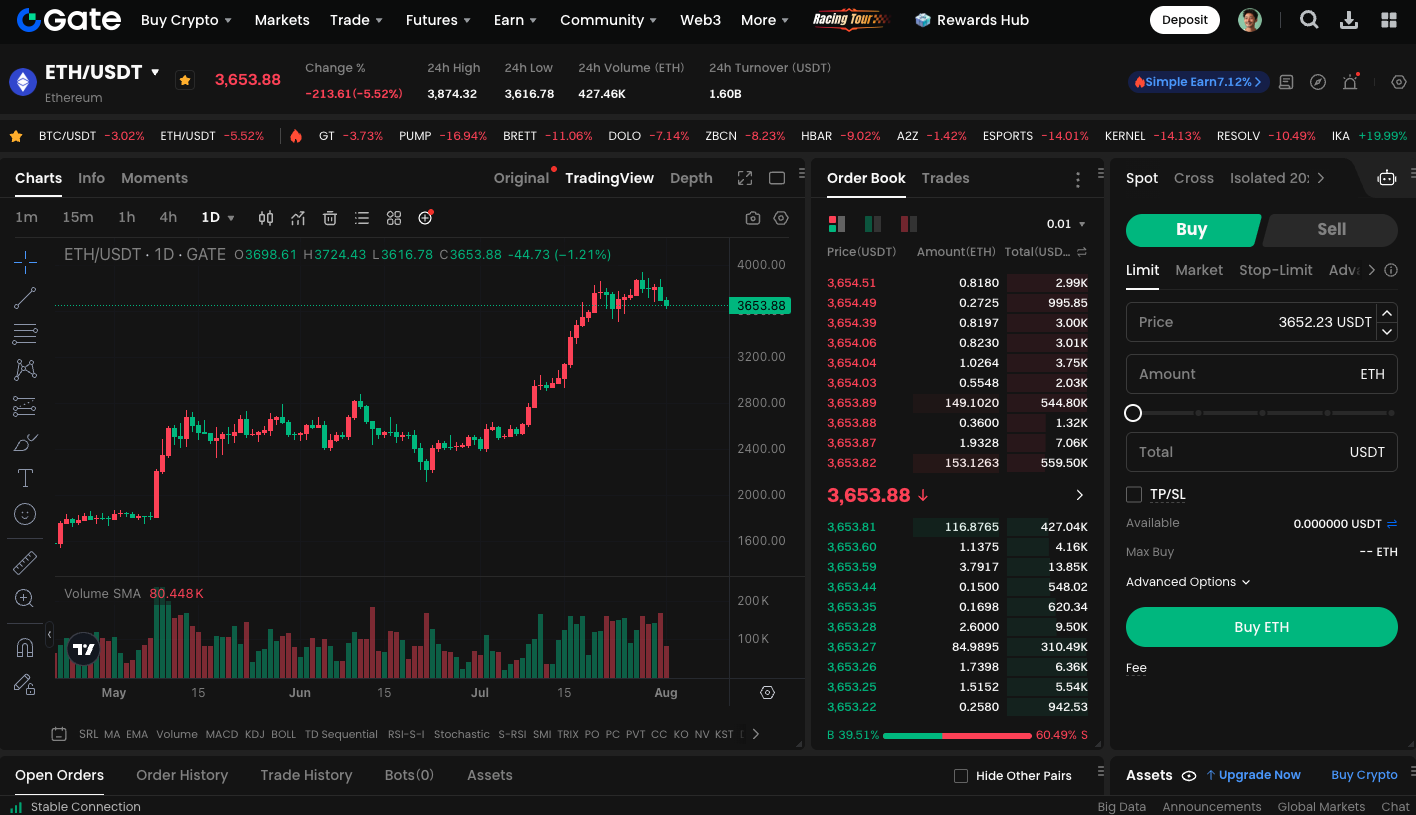

Start trading ETH on the spot market now: https://www.gate.com/trade/ETH_USDT

Summary

Driven by regulatory tailwinds, ETF inflows, derivatives market activity, and shifting investor sentiment, Ethereum is taking center stage in the latest wave of crypto asset growth. If staking ETFs roll out smoothly by year-end and macroeconomic conditions remain favorable, ETH could surpass $4,000. It may also be poised to target $4,500 or higher.