ETH Price Prediction: Ethereum Tests $4,000 Support, Breakdown Could Trigger 12% Drop to $3,500

Preface

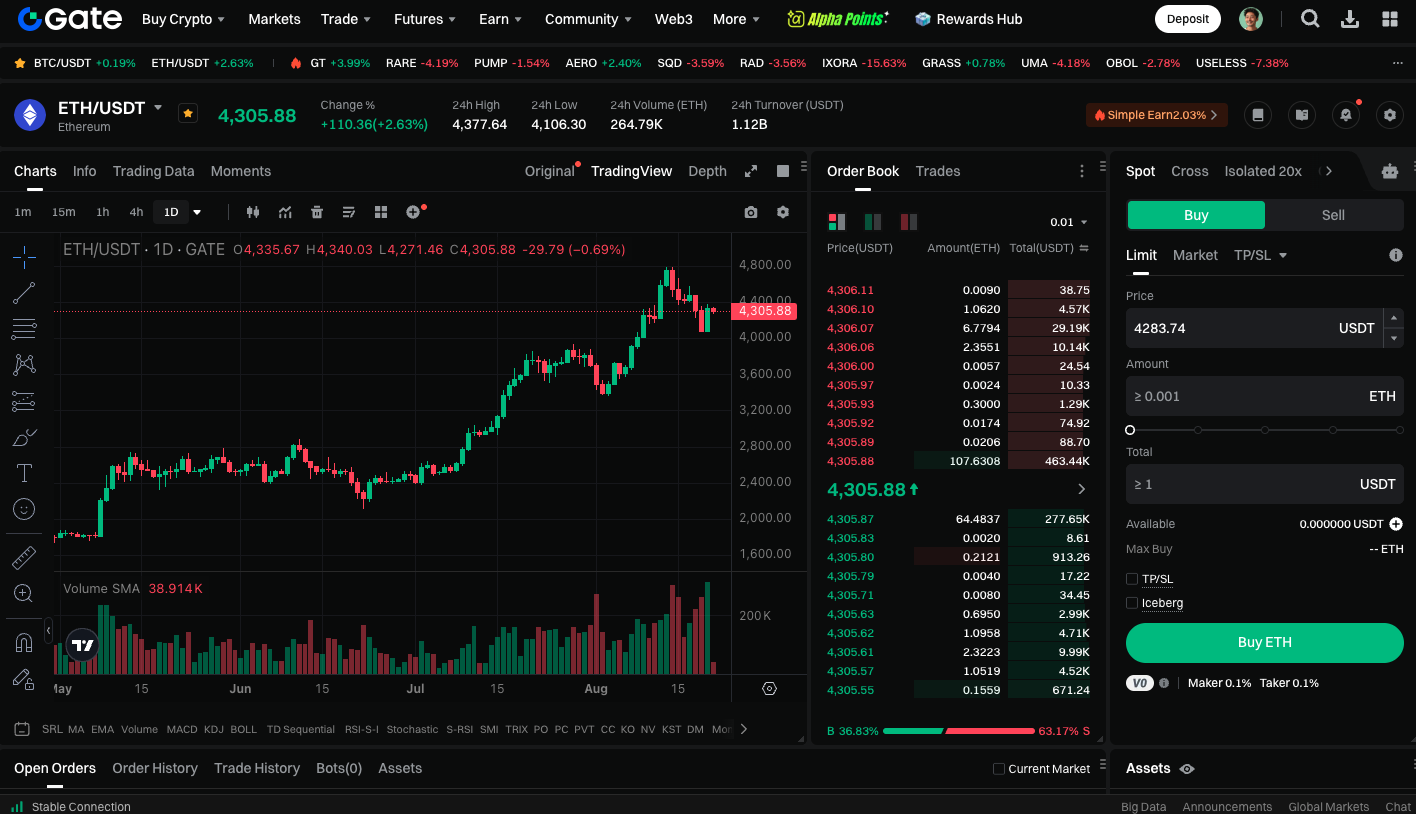

Ethereum (ETH) recently encountered significant selling pressure after challenging the $4,800 high, causing its price to retreat sharply. The asset is now consolidating around the critical $4,000 support level—a major psychological milestone and the midpoint of its technical price channel—making it the center of contention between bulls and bears.

Ethereum’s Market Share Is Being Eroded

On-chain data reveals that Ethereum’s average daily transactions have exceeded 1.7 million, approaching all-time highs. Meanwhile, Layer-2 solutions and new public blockchains continue to draw away user traffic: Arbitrum and Base together register over 12 million daily transactions, and Aptos logs 3.8 million—far surpassing the Ethereum mainnet. This structural shift has led to declining mainnet transaction fee revenue, with user attention gradually shifting to alternative ecosystems.

Technical Analysis: Can $4,000 Hold?

On the daily timeframe, ETH has entered a correction phase. If the $4,000 level holds, the market may experience sideways movement and potentially retest the $4,500–$4,800 range. However, losing this support could prompt further declines and test the strong $3,500 support—representing a possible downside of about 17%.

On-Chain Risks for Ethereum

The number of Ethereum network validators exiting has hit record highs. On August 20 alone, the validator exit queue surpassed 916,000—an all-time high. This signals that a large volume of previously locked ETH is about to return to circulation. If holders sell a significant portion, it will exert notable downward pressure on the price.

Unlike previous short-lived fluctuations, this wave of validator exits has persisted for several months, reflecting declining confidence among stakers. Without new demand to absorb selling, ETH could soon face a supply-demand imbalance. This increases the risk of a short-term price drop.

Trade ETH spot: https://www.gate.com/trade/ETH_USDT

Conclusion

While Ethereum’s long-term outlook remains bullish, short-term market uncertainty is rising. The $4,000 level is a key threshold—holding above it could spark a renewed rally; falling below may trigger a correction toward $3,500 or lower. Investors should closely monitor validator exit trends and watch if market demand can balance the increased selling pressure.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025