What is MYX Finance (MYX)?

What is MYX Finance?

(Source: MYX_Finance)

MYX Finance (MYX) leverages its proprietary Matching Pool Mechanism (MPM) to deliver a zero-slippage, highly efficient decentralized perpetual contract trading platform. Traders can access an on-chain trading experience that rivals—or even surpasses—centralized exchanges (CEXs).

MYX Core Trading Mechanism

Departing from traditional order book models, MYX utilizes its Matching Pool Mechanism (MPM) to automatically pair long and short positions. The liquidity pool acts as a passive counterparty, enabling instant execution and maximizing capital efficiency.

Zero-slippage trading: Orders are matched directly in the pool, eliminating reliance on order book depth and fully resolving slippage concerns.

Superior capital efficiency: Under ideal market balance, MYX can achieve up to 125x capital efficiency—dramatically outperforming traditional AMM protocols.

USDC margin collateralization: All perpetual contracts are collateralized in USDC, supporting leverage up to 50x to accommodate a range of trading strategies.

MYX challenges the liquidity depth and execution speed of CEXs within a decentralized framework.

Trading Process and Order Types

MYX provides a full suite of open and close order mechanisms, streamlining user operations:

Buy-to-Open: Open a long position by buying contracts—expanding total long open interest.

Sell-to-Close: Close a long position by selling contracts—contracting long open interest.

Sell-to-Open: Open a short position by selling contracts—increasing total short open interest.

Buy-to-Close: Close a short position by buying contracts—reducing short open interest.

This structure closely mirrors CEX workflows, but operates on-chain and the matching pool optimizes markets to bring equilibrium.

Liquidity Pool Role & Risk Management

The innovative core of MYX lies in its liquidity pool (LP), which serves as the passive counterparty for trades:

- Instant risk assumption: As traders open positions, the liquidity pool (LP) immediately assumes the opposing side, locking collateral to cover any potential losses.

For example: When a user opens a 1 BTC long position, the liquidity pool (LP) passively assumes a 1 BTC short position and locks up 1 BTC as collateral.

Gradual position transfer: The pool subsequently transfers these risk exposures to other traders as market demand shifts, restoring balance and further releasing capital.

Funding rate mechanism: When long and short sides become imbalanced, the side with greater open interest pays a funding fee to the other, incentivizing a return to a 50:50 market equilibrium.

This approach not only ensures deep liquidity, but also enables LPs to earn through both funding fees and market making activities.

Auto-Deleveraging (ADL) Mechanism

During periods of extreme market volatility, trading volume may soar and exceed the size of the liquidity pool. MYX triggers its Auto-Deleveraging (ADL) system, forcibly closing the most profitable counterparty positions to proportionally reduce both long and short open contracts. This mitigates systemic risk. It maintains market stability and ensures MYX operates securely even under high-leverage, high-volume conditions.

MYX Keeper Network: Fair On-Chain Matching

Legacy CEX matching engines operate as opaque black boxes, leaving traders in the dark regarding execution delays or manipulations. Many DEXs rely on centralized sequencers, limiting true fairness. MYX addresses these challenges with its Keeper Network—a decentralized network of community nodes responsible for executing trades transparently:

Open-source smart contracts: All rules are publicly auditable and immutable.

Tamper-resistant oracles: Price feeds are transparent and secure, protecting against price manipulation and abnormal swings.

Decentralized execution: 21 active nodes rotate weekly. Anyone can participate by staking at least 300,000 MYX to run for node elections.

Keeper duties include monitoring orders, updating price feeds, triggering settlements, recording on-chain history. They also handle rebates and revenue sharing. Nodes that fulfill these roles earn a share of trading fees, MYX buyback rewards, and operational incentives.

MYX Seamless Trading: Effortless User Experience

Beyond technical innovation, MYX prioritizes user experience with its Seamless Trading feature—delivering a CEX-like experience for decentralized traders:

No wallet signature required: Trades execute instantly without repeated manual confirmations.

Gasless operations: All actions—including registration and trading—incur zero on-chain gas, with fees automatically deducted in USDC.

Real-time multi-device trading: Fully browser-based access removes dependence on specific wallet apps.

With these features, MYX delivers a secure, self-custodial, and user-friendly decentralized trading experience.

MYX Finance Tokenomics

MYX has a total token supply of 1,000,000,000. Its tokenomics promote community development and ecosystem growth, while ensuring sustained support for the team, investors, and liquidity. Distribution is as follows:

Ecosystem & Community (54.7%)

Allocated for trader incentives, community rewards, and long-term ecosystem construction—ensuring decentralization and sustainable platform growth.Team & Advisors (20%)

Reserved for core developers and strategic advisors, supporting continuous technical advancement and governance.Institutional Investors (17.5%)

Early supporters contribute capital and resources in exchange for allocation—laying the foundation for project progress.Initial Liquidity (4%)

Ensures robust liquidity on both decentralized and centralized exchanges, supporting deep market activity.IDO via Binance Wallet (2%)

Allocated for IDO release to expand the reach and user base of MYX.Future Reserve (1.8%)

Maintained as a strategic reserve to address long-term uncertainties and future market needs.

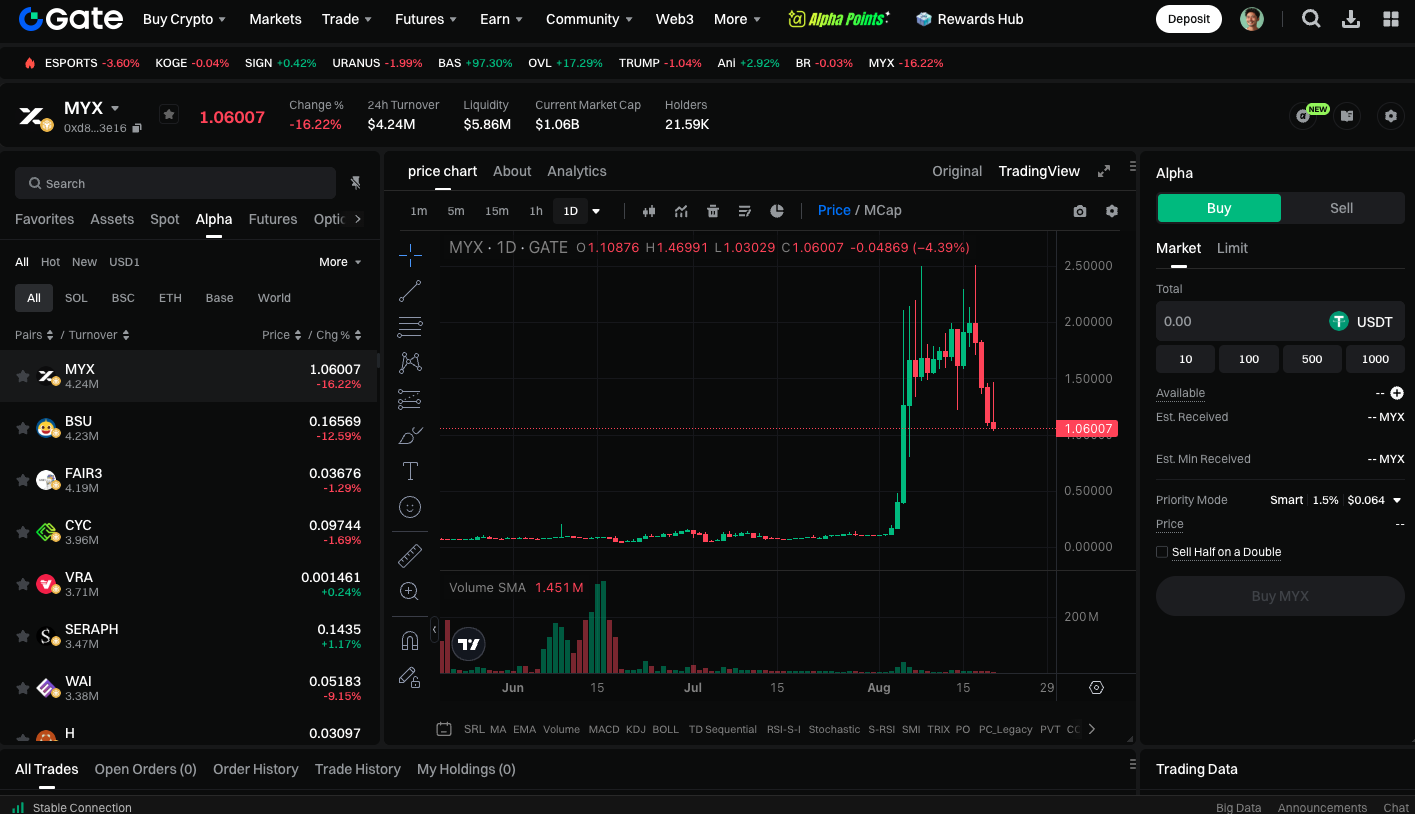

Trading for MYX Alpha is available: https://www.gate.com/alpha/bsc-0xd82544bf0dfe8385ef8fa34d67e6e4940cc63e16

Conclusion

MYX Finance (MYX) is more than just another decentralized perpetual contract exchange. Through innovations like the matching pool, Keeper Network, and Seamless Trading, it elevates DeFi derivatives trading to new heights. MYX addresses legacy DEX challenges such as slippage and fairness, while preserving the seamless experience users expect from CEXs. As the derivatives sector expands, MYX is poised to become a foundational pillar of on-chain derivatives infrastructure, supporting efficient, transparent, and frictionless trading.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025