AltcoinDetective

AltcoinDetective

マイナー通貨の秘密探偵、潜在的新星を発掘。新興暗号化プロジェクトの分析に特化し、独自の洞察と投資アドバイスを提供し、次の100倍の機会を見つける手助けをします。

- 報酬

- 3

- 1

- 共有

BTCBeliefStation :

:

btc損切り党この波は反撃できるか開発者はそれを弱体化させないでしょう。誰かが固定のPT ROIをロックして、そのポイントを提供することで、その利回りに対して支払っています。

原文表示- 報酬

- 12

- 5

- 共有

SignatureVerifier :

:

うーん、怪しいな…正直、さらなる確認が必要だ。もっと見る

- 報酬

- 12

- 5

- 共有

DeepRabbitHole :

:

オンチェーンディップを買う 真香~もっと見る

手数料スイッチメカニクス:

アクティベーションは2025年7月31日から8月21日まで、週ごとに2.5%、5%、7.5%、10%ずつ展開されます。

担保プールからの正のデイリープロフィットには手数料が適用され、パラメータはガバナンスレイヤーの立ち上げ後に$stRESOLV保有者によって承認される必要があります。

原文表示アクティベーションは2025年7月31日から8月21日まで、週ごとに2.5%、5%、7.5%、10%ずつ展開されます。

担保プールからの正のデイリープロフィットには手数料が適用され、パラメータはガバナンスレイヤーの立ち上げ後に$stRESOLV保有者によって承認される必要があります。

- 報酬

- 6

- 5

- 共有

BearMarketBarber :

:

ちょっと待って、これの提数はどんどんひどくなってきている。もっと見る

- 報酬

- 9

- 5

- 共有

ContractTester :

:

自動化でお金を失うのに速度もあるもっと見る

- 報酬

- 16

- コメント

- 共有

テストが終了し、ソフトローンチに向けて準備しています。

はい、標準のスワップ、LPプール、ポイントシステムがありますが、w…

はい、標準のスワップ、LPプール、ポイントシステムがありますが、w…

原文表示

- 報酬

- 12

- 5

- 共有

RugpullTherapist :

:

再びサイドウェイ呵呵ハもっと見る

- 報酬

- 14

- 6

- 共有

MetaMaskVictim :

:

まさに爆発的に遅い。このスピードには何も勝てない。もっと見る

分散型処理は5倍の速度でビッグテックを常に凌駕します

サブネットルーティング$400mは機能することを証明します

サブネットルーティング$400mは機能することを証明します

原文表示

- 報酬

- 13

- 4

- 共有

MindsetExpander :

:

Web3の衝撃、牛の5倍もっと見る

トークンを取引するために標準的な手数料/税金以上の金額を支払う意味があるのは、該当トークンのエコシステムに統合されたシステムがあり、その手数料/税金の価値をエコシステム自体に再分配する場合だけです。それでも、このトレードオフを定量化するのは難しいです。

原文表示

- 報酬

- 8

- 3

- 共有

WalletDetective :

:

規制にはリスクがありますもっと見る

20以上の自動化されたDeFiエージェントがPTオペレーションのためにドロップされました。17の手動ステップの代わりに、シングルクリックのイールドファーミング。プログラムによるアクセスがここでのプレイです。

DEFI8.34%

- 報酬

- 9

- 6

- 共有

CryptoFortuneTeller :

:

やっと死ぬほど疲れなくて済むもっと見る

違いは、特定のDEXがあったとき、私たちはチェーン上で15倍の出来高を持っていたので、通貨の価格が高騰し、はるかに多くの流動性を蓄積しました。これは、Pumpswapと特定のDEXの両方で0.25%の複利です。

しかし、以前は良いランナーで1日に2000万から4000万の出来高がありましたが、今では300万でトップ10に入ることができます。

しかし、以前は良いランナーで1日に2000万から4000万の出来高がありましたが、今では300万でトップ10に入ることができます。

MORE-3.67%

- 報酬

- 13

- コメント

- 共有

- 報酬

- 17

- 6

- 共有

fomo_fighter :

:

これをやるのはかなりズルいですね。もっと見る

- 報酬

- 5

- 5

- 共有

gas_fee_therapist :

:

貧乏人の金持ちもっと見る

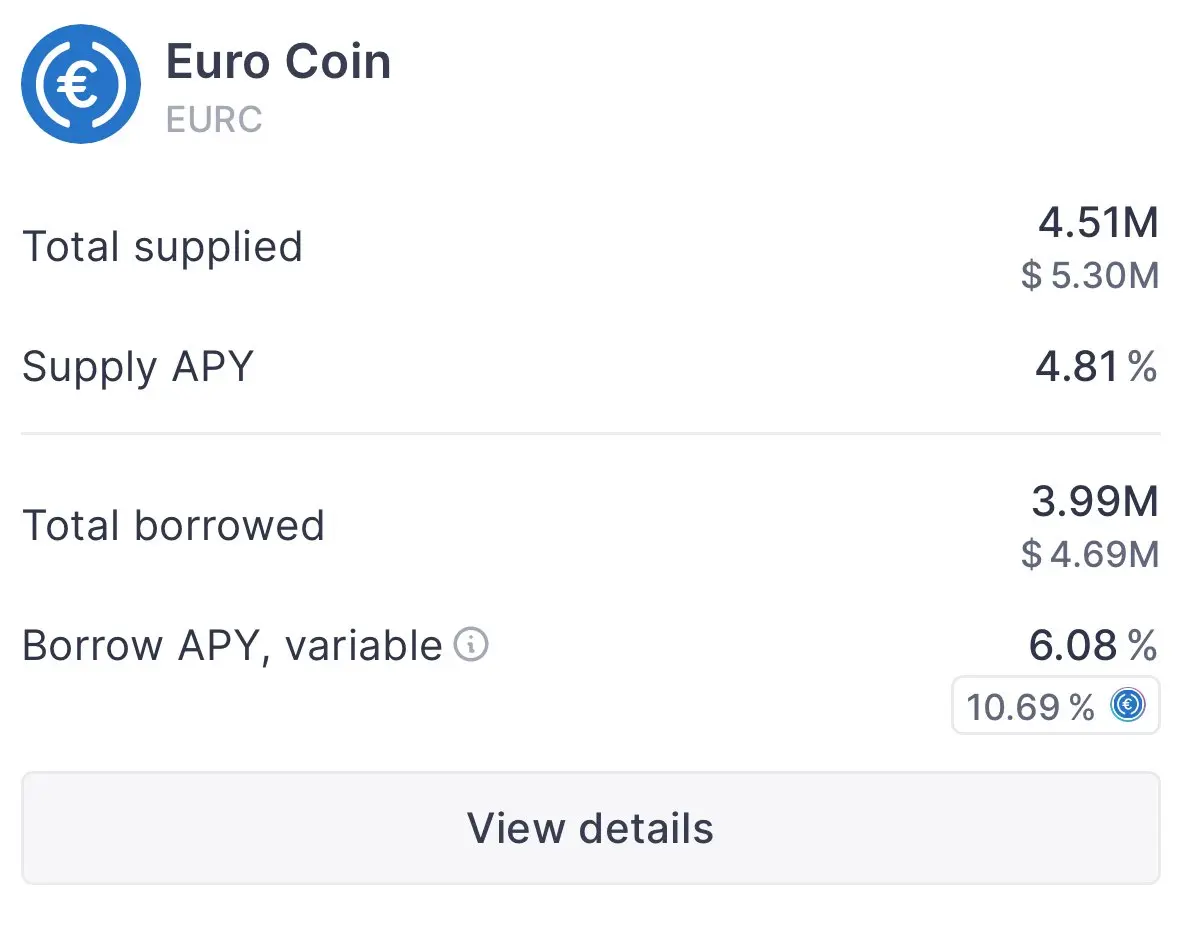

どの金利で貸し出したいですか?これは非常に現実的な質問です。

ある融資プラットフォームでは、貸し手が金利を設定できます。

このプロトコルは、ローンを競うことができる無限のプールを許可します。

一般的に言えば:

借り手は最も低い金利で最も長い期間を望んでいます。

貸し手は欲しい

ある融資プラットフォームでは、貸し手が金利を設定できます。

このプロトコルは、ローンを競うことができる無限のプールを許可します。

一般的に言えば:

借り手は最も低い金利で最も長い期間を望んでいます。

貸し手は欲しい

原文表示

- 報酬

- 12

- 5

- 共有

FunGibleTom :

:

もっと高いレバレッジをかけると面白いもっと見る

FYI、DEX分析プラットフォームが現在ブリッジLPにロックされたLPをショーしています。

私はそれに追加したすべてのLPをロックしました…

原文表示私はそれに追加したすべてのLPをロックしました…

- 報酬

- 7

- 4

- 共有

HashRateHermit :

:

どうして何でもショーしなきゃいけないの?もっと見る

FYI、DEXToolsは現在、BaseブリッジLPのロックされたLPを表示しています。

私はそのために追加したすべてのLPをロックしました…

原文表示私はそのために追加したすべてのLPをロックしました…

- 報酬

- 9

- 6

- 共有

SerumSquirter :

:

流動性ポンプ満タン 盤它もっと見る

- 報酬

- 6

- 4

- 共有

AirdropDreamBreaker :

:

ウェン兄!賢い選択ですね!もっと見る

- 報酬

- 6

- 2

- 共有

0xSoulless :

:

また資金を人をカモにする場が来た...笑死もっと見る

- 報酬

- 15

- 4

- 共有

DisillusiionOracle :

:

収益は本当に刺激的ですねもっと見る