Trilemma⤵️

1⃣ Systemic Risk: Shared-pool protocols create contagion where one asset failure can cascade across entire eco.

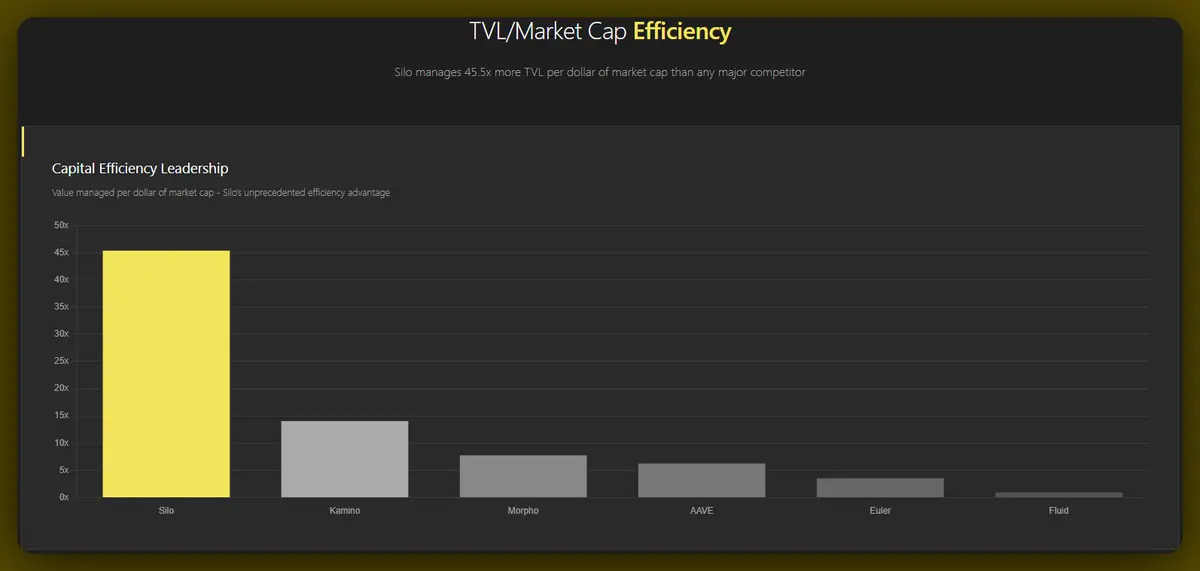

2⃣ Capital Inefficiency: Conservative risk management fragments liquidity and limits the assets protocols can safely support.

traditional lending protocols still pile every asset into one giant pool and hope nothing breaks. Sooner or later there's always cracks🥲

What about Silo?!

🔷Silo's Architectural Innovation and how it works:

And the best part? It’s permissionless. Want a market thats not on Silo yet?! The go ahead and spin it up

It’s secure. It’s composable. It act

1⃣ Systemic Risk: Shared-pool protocols create contagion where one asset failure can cascade across entire eco.

2⃣ Capital Inefficiency: Conservative risk management fragments liquidity and limits the assets protocols can safely support.

traditional lending protocols still pile every asset into one giant pool and hope nothing breaks. Sooner or later there's always cracks🥲

What about Silo?!

🔷Silo's Architectural Innovation and how it works:

And the best part? It’s permissionless. Want a market thats not on Silo yet?! The go ahead and spin it up

It’s secure. It’s composable. It act

EVERY0.03%