Neutral Market Strategies

In options trading, neutral market strategies refer to option combinations deployed when there's no clear view on market direction (up or down), aiming to profit during low volatility or sideways market conditions.

Iron Condor Strategy

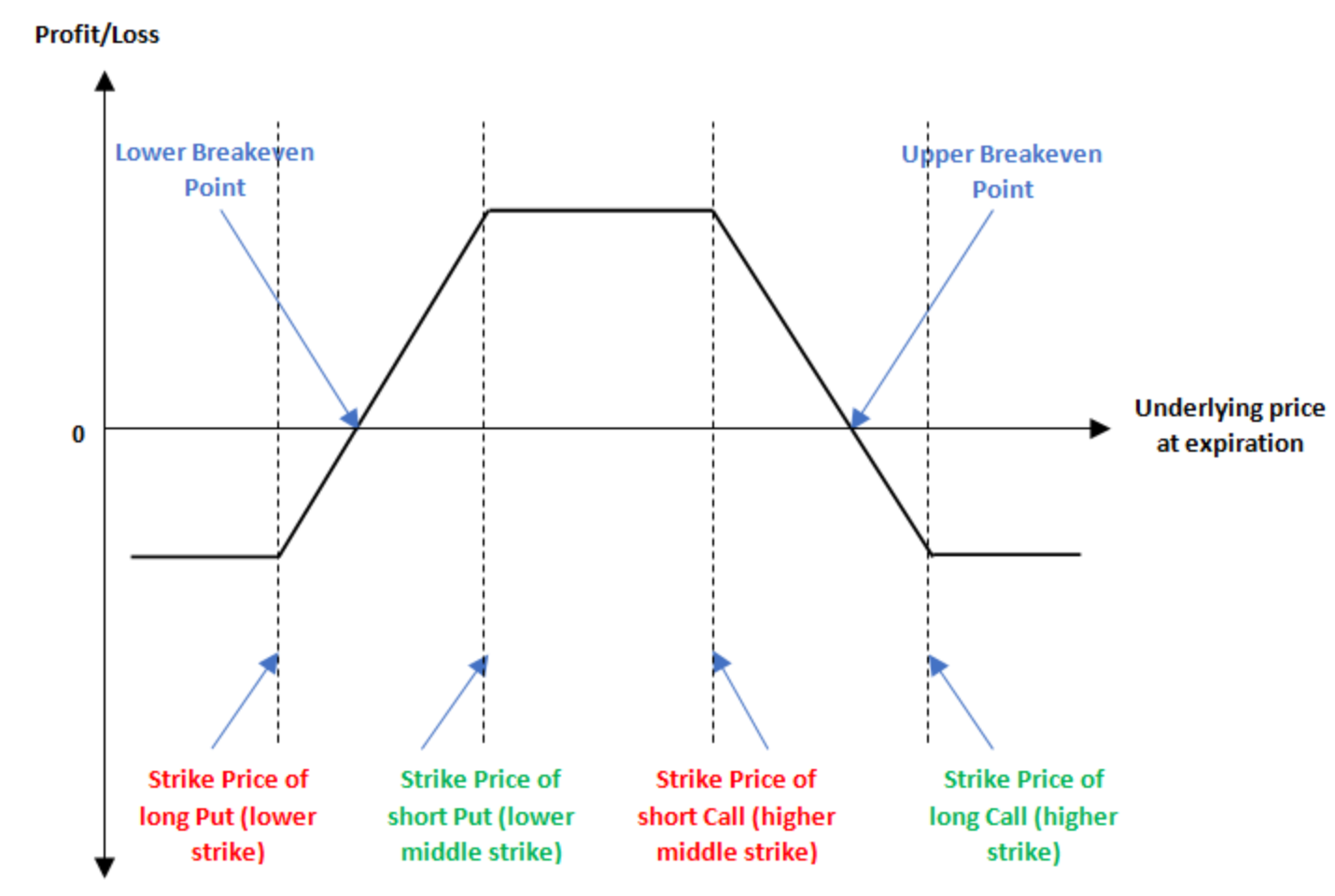

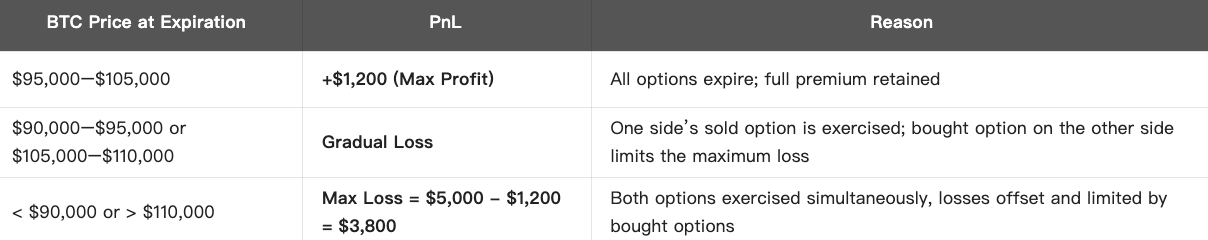

Iron Condor is a classic neutral options strategy suitable when expecting the underlying asset price to trade within a range without significant upward or downward movement. It combines bull and bear vertical spreads, allowing traders to profit when prices remain stable while keeping both maximum risk and reward limited.

Example (Using BTC):

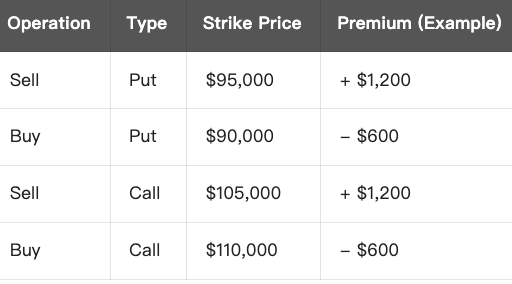

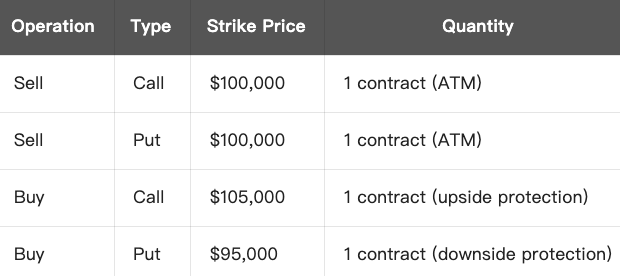

Assume current BTC price is $100,000, you believe BTC will trade between $95,000 and $105,000 over the next few days, so you construct the following strategy:

Net Income (Max Profit):

- Total Income = $1,200 (Put) + $1,200 (Call) = $2,400

- Total Expense = $600 (Put) + $600 (Call) = $1,200

- Net Income = $1,200 (max profit)

PnL at Expiration:

Strategy Summary:

Conclusion:

Iron Condor is a low-risk, medium-reward options strategy well-suited for sideways, directionless markets. It profits from time decay and a drop in volatility.

Neutral Butterfly Strategy

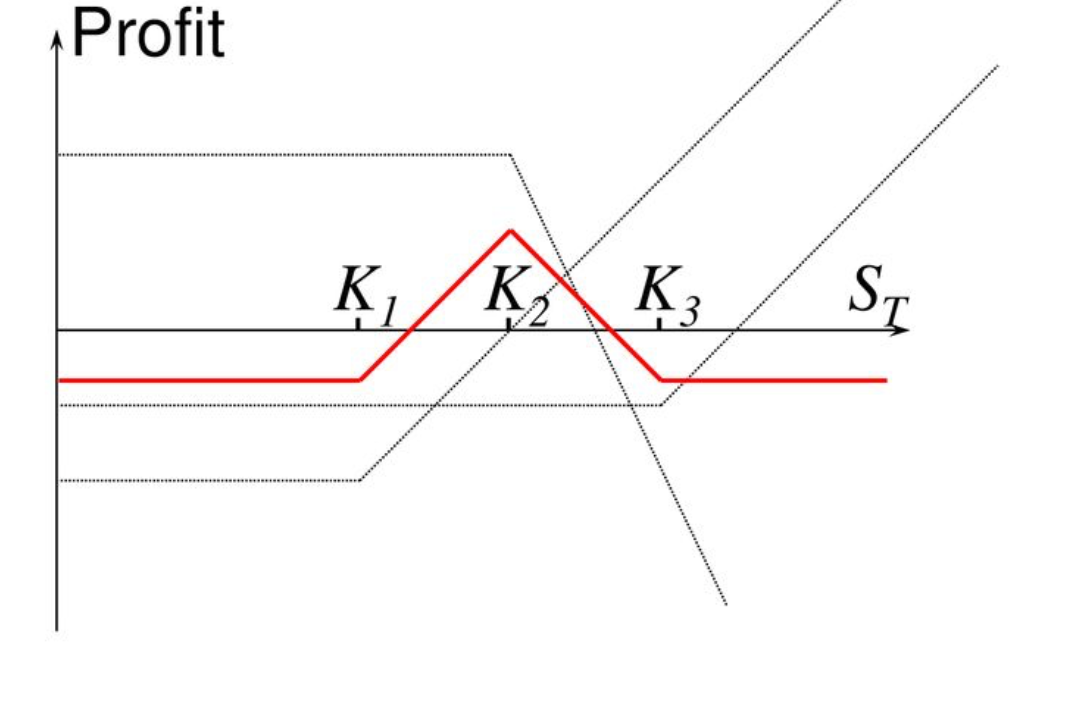

In options trading, the Butterfly Spread is a typical neutral strategy, suitable when expecting the underlying asset to expire near a specific price, i.e., minimal price movement or low volatility. This strategy features:

- High win rate if price stays near the middle strike

- Known maximum risk

- Low cost, high reward/risk ratio

Applicable Markets:

- Underlying asset is consolidating short-term

- Market expects declining volatility

- Investors are uncertain about the direction but confident the price won’t deviate far

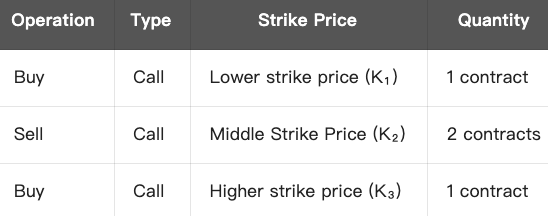

Strategy Structure (Using Call Butterfly):

Requirements: K₁ < K₂ < K₃ and K₂ is the expected price at expiration

Example: BTC Current Price = $100,000

You expect BTC to consolidate around $100,000, so you construct the following neutral butterfly strategy:

- Ideal Case: Total Expense = $6,000 + $2,000 - $8,000 = $0

- In Reality: Costs may be $100–$300

PnL at Expiration:

- Max Profit = Strike Spread × Number of Contracts - Cost, e.g., $105,000 − $100,000 = $5,000

- Max Loss = Initial Cost (If it is net expense)

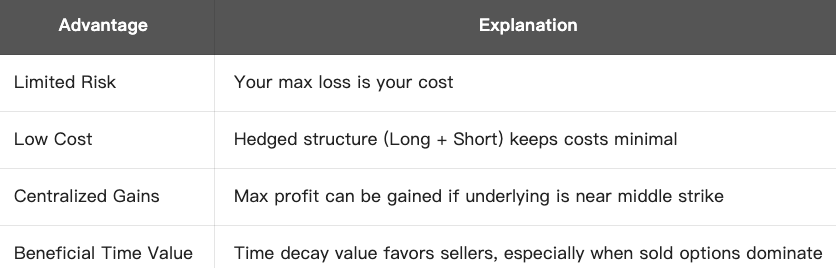

Advantages:

Risks & Limitations:

Conclusion:

Neutral Butterfly Strategy is a low-cost, risk-controlled strategy, suitable for the sideways market when expecting price to “stay put” in a certain range, capturing maximum profit near the center.

Iron Butterfly Strategy

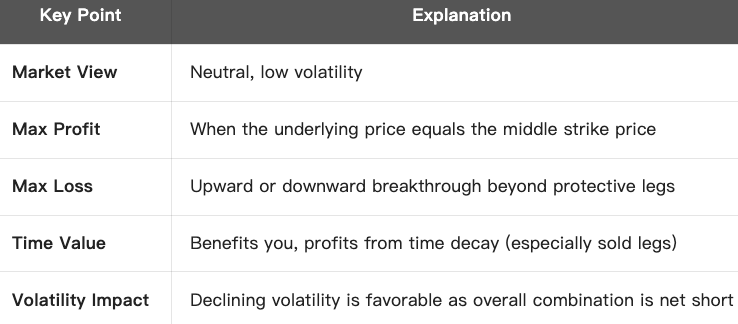

Iron Butterfly is a classic neutral options strategy suitable when expecting the underlying asset to stay near a specific price at expiration with low volatility. It combines features of both Butterfly Spread and Iron Condor, offering limited risk and limited reward.

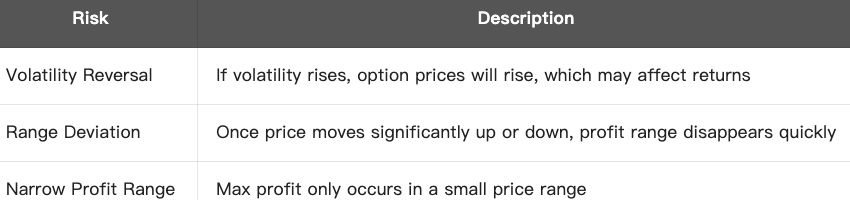

Strategy Components:

- One sold ATM (at-the-money) Straddle (selling ATM Call and Put)

- Then buy higher strike Call and lower strike Put (protection)

Example (Using BTC):

Strategy Goal:

You expect BTC to consolidate around $100,000 without significant up or down movement, so your goal is to profit from the premium through this combination.

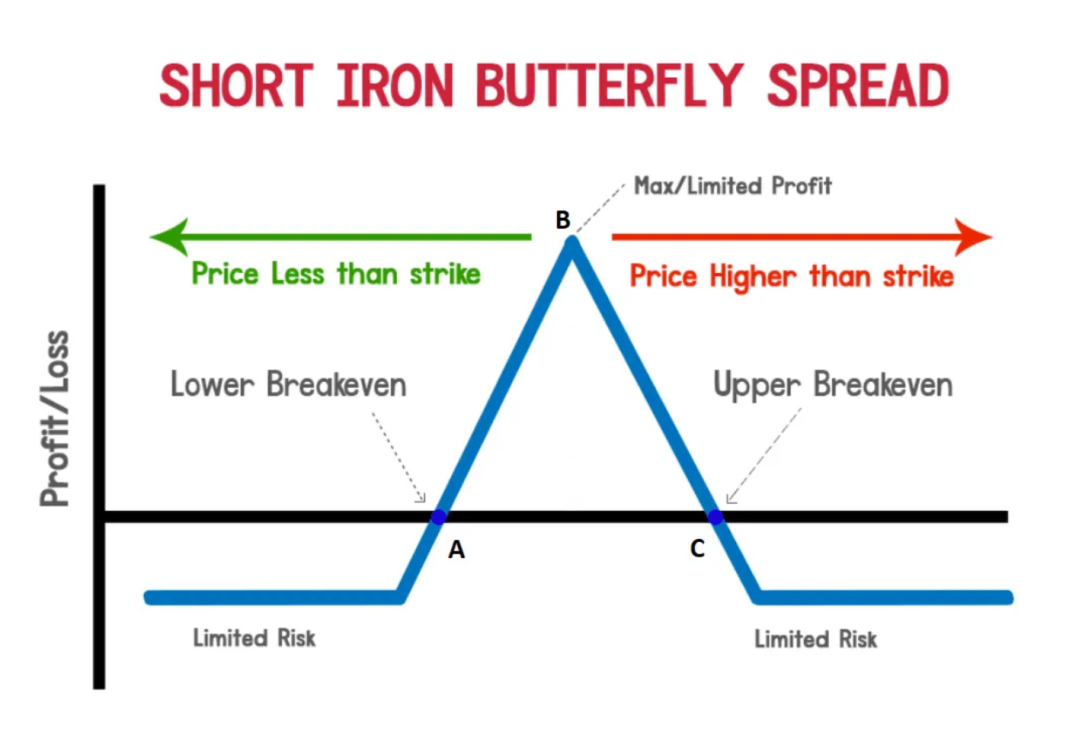

Profit Analysis:

Maximum Profit:

- Occurs when the BTC expiration price is exactly equal to $100,000

- All options remain unexercised, keeping all sold Call and Put income

- Max Profit = Total Premium Received - Premium Paid for Protective Options

Maximum Loss:

- When price is far above $105,000 or below $95,000

- Sold options become deep in-the-money, loss is capped by the corresponding protective leg

- Max Loss = Strike Spread - Net Premium Income

Example (Using BTC):

- Net Premium Income = $4,000 + $4,000 − $1,500 − $1,500 = $5,000

- Max Profit = $5,000 (When BTC = $100,000)

- Max Loss = $5,000 (Strike Spread $5,000 − Profit $5,000 = 0)

→ In this idealized example, the breakeven points are :

- Downward Breakeven: $100,000 - $5,000 = $95,000

- Upward Breakeven: $100,000 + $5,000 = $105,000

Strategy Summary:

Conclusion:

The Iron Butterfly is a risk-controlled, low-cost strategy suitable for sideways markets, providing maximized time value income when underlying price remains stable.